Advisory - KYC Compliance

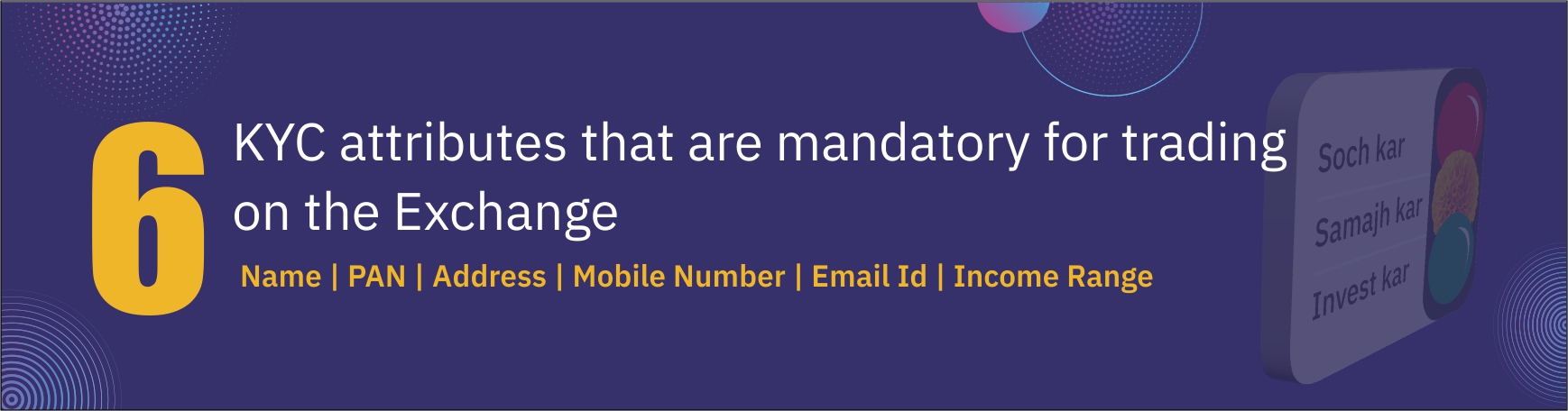

- 6 KYC attributes viz Name, Complete address (including PIN code No. in case of address of India), PAN, valid Mobile number, Valid email-id, Income details/range and details of custodians for the custodian settled clients has been made mandatory for Investors.

- In instances, where the aforesaid 6 KYC attributes are not updated, the trading accounts would be considered as non-compliant and would not be permitted to trade at the Exchange.

- To ensure smooth settlement, the investors are requested to ensure that both the trading and demat accounts are compliant with respect to the KYC requirement.

- Investors are required to ensure that they comply with the requirement of linking their Aadhar Number with PAN by March 31, 2023. Investors whose PANs are not seeded with their Aadhar Numbers by March 31, 2023 shall not be permitted to trade w.e.f. April 01, 2023 as their PANs shall be rendered inoperative.

- The investors are hereby requested to comply with the regulatory guidelines issued by Exchanges and Depositories from time to time with regard to KYC compliance and related requirements.

Updated on: 02/01/2023