Focus on FPIs

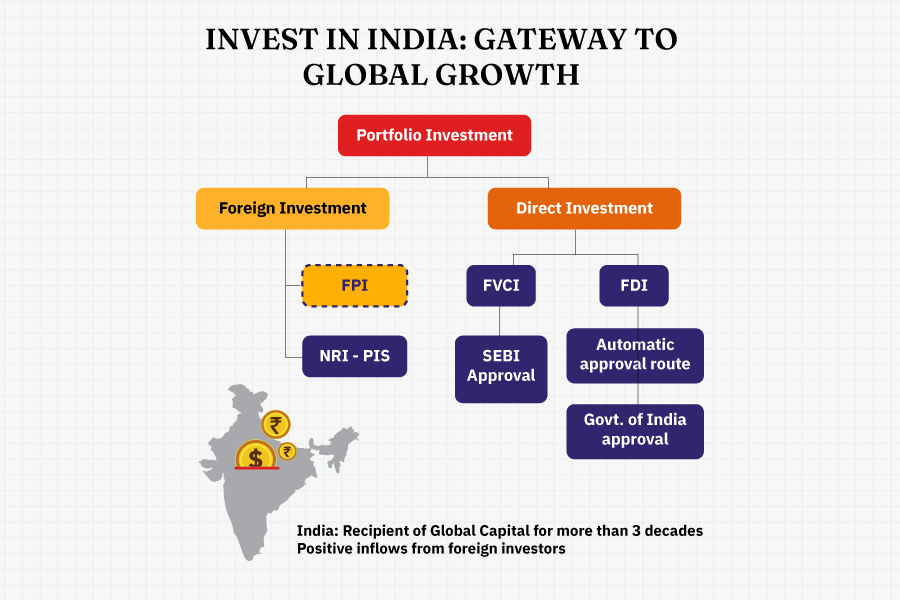

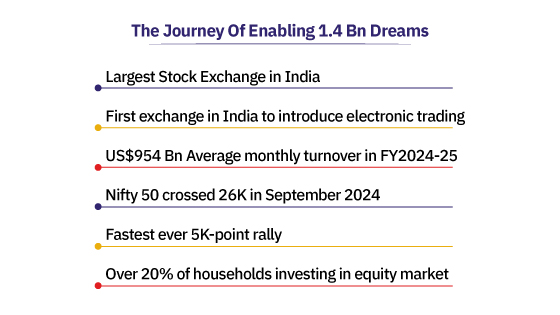

The Indian share market witnessed transformational growth which evolved into one of the world’s most dynamic investment destinations, during Manmohan Singh’s tenure as Finance Minister and later as Prime Minister. His policies paved the way for a market-driven economy, attracting foreign investment and fostering the growth of new sectors. The changes helped India transition from a heavily regulated economy to one driven by markets and competition. This period also saw the establishment of the NSE in 1994, which revolutionised Indian capital markets by introducing electronic trading and transparency, further boosting investor participation. The NSE's introduction complemented the broader liberalisation push by modernising the market infrastructure & attracting foreign investors. Currently, there are 11,650+ FPIs registered in India. Please refer the link below for the same:

Before the foundation of SEBI, the securities market was regulated by several government institutions, resulting in inconsistency and inefficiency. SEBI which was founded in 1992 is the regulatory and registering authority for the various intermediaries and institutional investors connected to the securities market. The Preamble of the Securities and Exchange Board of India describes the basic functions of the Securities and Exchange Board of India as to protect the interests of investors in securities and to promote the development of, and to regulate the securities market and for matters connected therewith or incidental thereto. Please refer the following links for FPI regulations and FPI master circular:

SEBI introduced the Custodians (which are market intermediaries) to undertake the role of Designated Depository Participant (DDP) in India and perform due diligence as per FPI regulations & grant certificate of registeration to FPIs on behalf of SEBI. The DDP supports market entry process by performing the market registeration process & also provides support in licensing accompanied by implementation of a risk-based Know Your Client (KYC). The FPI is required to enter into an agreement with the respective DDP, to act as Custodian of securities, before making investments under FPI Regulations. Kindly refer the link below for the DDP list:

https://www.sebi.gov.in/sebiweb/other/OtherAction.do?doRecognisedFpi=yes&intmId=4

| Market Segment | Type of Instrument |

|---|---|

| Equity | Listed |

| Preference Shares (fully, compulsorily, and mandatorily convertible) | |

| Warrants | |

| Corporate Bonds – Convertible (compulsorily and mandatorily) | |

| Partly Paid Shares | |

| Fixed Income | Dated Government Securities |

| Treasury Bills | |

| Municipal Bonds | |

| Commercial Papers | |

| Repo Transactions (Only under VRR) | |

| Corporate Bonds - Non-convertible | |

| Corporate Bonds under default | |

| Unlisted Corporate Bonds – Non-Convertible | |

| Debt Instruments Issued by Banks, Eligible for Inclusion in Regulatory Capital | |

| Credit Enhanced Bonds | |

| Rupee Denominated Bonds/ Units Issued by Infrastructure Debt Funds | |

| Securitised Debt Instruments | |

| Mutual Funds | Units of Mutual Funds |

| Exchange-Traded Funds (ETFs) | |

| Derivative Contracts | Index Futures (Exchange-Traded Derivatives (ETDs)) |

| Index Options (ETDs) | |

| Stock Futures (ETDs) | |

| Stock Options (ETDs) | |

| Interest Rate Futures (ETDs) | |

| Currency Derivatves (ETDs & OTC) | |

| Cross-Currency Derivatives (ETDs) | |

| Interest Rate Swaps | |

| Securities Lending and Borrowing (SLB) Segment | Listed Equity |

| Others | Units of Collective Investment Schemes |

| Security Receipts Issues by ARCs | |

| Category-III Alternative Investment Funds | |

| Units of Real Estate Investment Trusts (ReITS) | |

| Units of Infrastructure Investment Trusts (InvITS) |

CONNECT WITH US:

National Stock Exchange of India Ltd.,

Exchange Plaza, C-1, Block G, Bandra Kurla Complex,

Bandra (E), Mumbai – 400 051

EMAIL ID: DL-FPI-BD@nse.co.in